Rather than make DC a state, why not give the residential section of the District back to Maryland and leave the mall and non-residential area as the District of Columbia?

Category Archives: Politics

Civics Lesson

In light of the recent insurrection, where citizens invaded the Halls of Congress, disrupting the primary business of our democracy as it was happening, I would like to propose a law:

As a requirement to graduate from high school, or to enter government service, either in the military or civilian branches, you must be able to pass the same civics test new citizens are required to take.

There are 128 questions. You have to correctly answer 12 of 20. The test is broken down into three sections: American Government, American History, Symbols and Holidays. (The Radical Republicans released the latest version of the test in December, 2020 , and their influence is felt. )

I include the government service folks since many are required to swear to defend the Constitution and it would be useful for them to know what they are swearing to.

Happy New Year! 2020

Happy New Year! 2020 – the year of Hindsight! I hope it is your best one yet.

2019 wasn’t the best of years, though we did get a chance to visit Ireland, meet some cousins, and attend a Worldcon, as well as a brief visit to Iceland on the way back. Between travel and medical issues I only got to spend half a year on the golf course. The good news is that, medically, I am back in the pink for 2020. Physically, I need to continue the exercising and stretching I began last year with the Silver Sneakers program down at the gym. That should also help on the golf course.

As we enter the election year, I am conflicted. I support Bernie Sanders wholeheartedly. I believe his Democratic Socialism platform is the best for the US moving into the 21st century. Our own Constitution starts with “We the People” and mandates to:

- form a more perfect union,

- establish justice,

- insure domestic tranquility,

- provide for the common defense,

- promote the general welfare,

- secure the blessings of liberty for ourselves and our descendants,

if that’s not Socialism, I don’t know what would be. But, the man is 78 years old; I really believe he would not survive first first term. I wish he had a groomed successor in his 50’s ready to go, but the other Democrats in the running don’t seem ready to adopt his platform. This also means his VP pick will be critical and I expect that “politics” will give us a less than optimal successor. It will be an interesting year.

I do think it is time for Congress to take back its constitutional duties and to stop ceding them to the executive. Especially sending American sailors, marines and soldiers into combat at the whim of the executive. Congress opened the door about letting the Executive use military force without direct Congressional approval and the Executive has ripped the door off the hinges. Our military actions throughout the world over the past 70 years have not been the actions of a democratic republic promoting its ideals to the world.

What we do seem to be doing is making the world safe for business. Not safe for the people who patronize the businesses but the businesses themselves. And to add some confusion to the mix, businesses are becoming multi-national and and by making the world safer for business we are making it less safe for ourselves, since if the business is engaging in practices our country deems unsafe, they will just move to another country that doesn’t prohibit or limit those practices. The practices are still unsafe and continue to create a harmful environment; it is just at a remove from us. And we still protect the overall business that is engaging in these practices. Realistically, we need to ban/prohibit these businesses from doing business in our country if we find them engaging in practices that we prohibit here because they are harmful.

Business concentrates money, politics concentrates power, concentrated money buys concentrated power, concentrated power can intensify concentrated money. We need to break this cycle. Let’s start by diffusing the power. Let Representatives have a maximum number of constituents, say 100,000 per Representative. Triple the size of the Senate and let the top three vote-getters be seated in each Senatorial election. Set a restriction that a person cannot hold successive terms of office. A Congressional incumbent can not run for the same office, but they can run in the following election when they are not the incumbent.

Congress should also incorporate sunset timelines into every bill, say 20-25 years, then the bill/law expires. Of course Congress may just reaffirm all the sunsetting bills en mass, so we restrict that so no more than half of the sunsetting bills can be approved in a bundle. The rest must be approved on to case-by-case basis.

On the money side:

- 90% estate taxes on estates in excess of $5,000,000 should help prevent the concentration of wealth.

- Political contributions can only come from registered voters or Citizens. Get businesses out of politics.

- All political contributions are publicly available for review.

- 90% income tax on incomes over $5,000,000 should help as well.

Actually, I have a whole income taxing scheme that I will discuss in a later post.

Happy New Year! Let the Fun Begin!

Minimal Wage

Once again the discussion of minimum wage is coming to the forefront of political discussion. There is a lot of vocal support for a $15 an hour minimum wage. I think that is a few dollars more per hour than necessary for a national minimum wage.

A minimum wage should be able to provide the wage earner with a basic living wage. The national poverty level for a family of four is in the neighborhood of $24,000 a year. A person working full-time, 40 hours a week, 50 weeks a year will work 2,000 hours a year. Using these numbers, $12 an hour is a reasonable minimum wage – nationally.

Now, within some urban areas (Metropolitan Statistical Areas) the effective poverty level for a family of four is much greater than national level and it would be very appropriate to tie the minimum wage to HUD’s Extremely Low Income for a family of four for an area, or to the national poverty level for a family of four, whichever is greater. Such that, in San Francisco, the ELI for a family of 4 is $44,000 so a minimum wage for that area should be $22 an hour. In Seattle, the ELI is $32,100, which would lead to a $16.50 per hour minimum wage. In the Bronx, the ELI is $31,300, which will lead to a $15.65 per hour minimum wage.

We have the facts and figures derived from the various government departments that track this data, such as the Census Bureau, HUD, Social Security, the Fed, HHS, etc. Let’s use this data responsibly and keep on top of the growing economy and the wage gap. And the numbers can change every year as the economy grows and we don’t strand people at an old wage for many years while the politicians pontificate.

Interesting view on the growth of wages

I came across this link to SSA income data. I see that the average salary/wage is growing faster than the median salary/wage. So this shows that the majority of the workers continue to get more and more relatively poorer than the “average” worker.

In the upper left of the SSA page is a link to yearly breakdowns of the annual wages. Here is a link the 2017 numbers. It shows the breakdown of the number of earners in each income band, up to 205 people who earned more than $50,000,000. The total of those 205 people was $19,954,445,874.88 for a average of $97,338,760.37 each.

In 2016, only 143 people earned more than $50M with an average of $100.7M each.And in 2015, it was 202 people with an average of $91.4M each. Looks like a lot of volatility at the top.

An interesting page to fiddle with to see where the inequity grows.

A Review of a News Conference

I’m glad someone went through the transcript, it was a little too chaotic for me.

Why should we trust you?

Well, I don’t know.

Fair enough.

Hmmm

Looks like things are progressing in Colorado Springs. From Gary, a friend-

Events for Progressives in Colorado Springs

Tuesday Feb. 7 10:30 at Senator Cory Gardner’s Co. Springs office

Tuesday Feb 7, 5:30 Together Colorado Springs meeting, Stargazer Theatre

Friday, February 10 Colorado Springs Feminists 7:00 PM

“Are Human Rights Women’s Rights”

Saturday, Feb 11, 2:00 PM First Strike Theatre at Seeds Cafe.

=========================================================

Tuesday Feb 7 10:30 AM- 12pm

102 N. Tejon Ste. 930, Colorado Springs, CO

Join us in visiting Senator Gardner’s office to resist Trump! We’ll arrange to speak with a staffer about what ever topic has your blood boiling that day. Last week we had almost 100 people gathered on the sidewalk, and cycling through the office in groups of 10.

While waiting for our turn, we’ll keep the street active with sign waving and Chanting. Bring a drum, a whistle, a small flag to wave, a list of great chants you have been hearing.

========================================================================================================

Tuesday, Feb 7 5:30 PM, Stargazer Theatre 10 S. Parkside Drive, Colorado Springs, near Pikes Peak Street.

Announcement meeting for new non-partisan Political Action group, “Together Colorado Springs” (TCOS). Founded by CS Independent creator, John Weiss and several liberal community leaders, the group planned to have a paid staff helping to get progressive and liberal causes toward the top of local agendas.

There will be music, powerful speeches and other entertainment. They are asking $30 per person admission, but also promising that no one will be turned away if they can’t pay that amount.

==============================================================

Friday, CS Feminists “Are Human Rights Women’s Rights”.

Hosted by the Colorado Springs Feminists 7:00 PM

Private Residence 2727 N. Tejon , Colorado Springs,

Why do we fight for “women’s rights” if they’re encompassed by broader “human rights”? We’ll kick off the second installment of our Discussion Series with this question, and peel back the layers of these terms and their implications. No need to have attended the first installment to attend this one! Optional readings to inform the discussion are below.

Optional readings:

“Women’s Rights are Human Rights” Hillary Clinton, 1995, at the United Nations Fourth World Conference on Women in Beijing.

“Are Women’s Rights Human Rights?” by Rosie Walters, 2013, available at http://www.e-ir.info/2013/07/20/are-womens-rights-human-rights/

=================================================================

Saturday, February 11, 2017 2:00 PM Seeds Community Cafe

109 E Pikes Peak Avenue, Colorado Springs, CO (edit map)

Co. Springs’ own “First Strike Theatre” will present a lively and funny show feature local actors,

and custom written songs to fit our current political mess. They will do 2 shows, 2:15 and 3:15 . The event is Free. They might ask for donations??

The event is to “Celebrate” the birth day of “Raw Toos”, a non-profit that encourages turning guns into useful items that don’t kill people. There will be two performances, at 2:15 and 3:15 on Saturday, Feb 11 at Seeds Community Cafe at 109 E. Pikes Peaks. Its a small place, so place to arrive early.

If the drumbeat of bad news has been getting you down, come to this show and spend some time laughing about Mary Springer-Forse’s unique way of writing, and singing, about our current mess.

=============================================

A letter to my rep

Dear Mr. Lamborn,

I have been hearing disturbing rumors that Congress is looking to get rid of my health care plan. I would not appreciate that. I need affordable health care to survive in this world. And by affordable, I mean a plan that provides me health care for less than 20% of my income. (10% would be optimal)

I understand one of your compatriots implemented a pretty good health care plan in Massachusetts a few years ago. Romneycare, I think it was called. Maybe you should try rolling this out on a national level if you aren’t satisfied with the current Affordable Care plan.

I would also remind you of the Preface of the Constitution that you just read and swore to defend; one of the purposes of this country is to promote the general Welfare. I think a federal healthcare insurance plan would go a long way towards that promotion.

And, consider adding dental to the overall plan. I think that good dental health is important to good overall health.

Yours,

Jack Heneghan

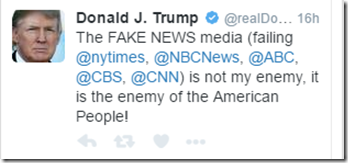

information warfare

Jim Wright makes a lot of sense of a muddled field.

http://www.stonekettle.com/2016/12/blind-spot-part-ii.html

(I wonder how this will present itself when it is copied to the other platforms I share to?)

And here are some weapons for the war –

http://www.npr.org/2016/12/11/505154631/a-finders-guide-to-facts

What Next??!!

Dodd-Frank will be dismantled. Banks will be under no obligation to avoid the risky business practices that collapsed our economy 8 years ago.

EPA Transition team is headed by a climate-change denier.

Dept of Energy transition team is headed by a Koch lobbyist.