EXCLUSIVE: photos of BofA’s new #OWS-themed ad campaign – Boing Boing.

I especially like the “Building a better America, 1% at a time.”

EXCLUSIVE: photos of BofA’s new #OWS-themed ad campaign – Boing Boing.

I especially like the “Building a better America, 1% at a time.”

I have gotten tired of all the nonsense hits I am getting on Google, so I am trying out another search engine -blekko. I made it my default Firefox search engine.

It seems on Google that if you inquire about a subject then you must want to be buying it. No, if I ask about “bookbinding” I want to learn about “bookbinding” not buy “bookbinding”equipment or books.

I started thinking about this after hearing PJ O’Rourke on Marketplace. This was an essay answering the question about “If the 1% had less, would the 99% be better off?”

We have a pie that represents the wealth of America. The “1%” controls about 38% of that wealth (2011). The “20%” (that includes the 1%) controls 88% of the nation’s wealth.

If we use a net worth of $56T (2011) then 38% = $21.3T and 88% = $49.3T.

Wealth is not zero-sum. In 2007 American wealth was over $65T and the control percentages were 1-2 percentage points lower. So while the overall net worth dropped 16% the top “20%” lost only -3% of their share of the pie (going from 85% to 88%). I wonder where the rest of the loss came from?

Wealth is not zero-sum. But the pie is. It sums up to 100% whether the net worth is worth $65T or $56T. If the top “1%” keeps a lock on $20T and the net worth figures keep falling, their percentage of the pie keeps going up. and the “99%” keeps getting squeezed as their percentage goes down.

It isn’t a matter of declaring wealth is evil or that reward for success is bad. It is a matter of saying that using wealth to promote a playing field that favors your increasing your wealth is bad. Buying the influence to set the field in your favor is bad. Gaming the system with a disregard for intent is bad. (Fraud is fraud, unless you can do enough semantic acrobatics to rob everyone blind, legally.

I don’t disparage the 20% their wealth. No matter how you cut the pie, there will always be a 20%. But 88% of the wealth seems a bit much for 20% of the population.

First thing – DO NOT RE-ELECT any incumbents. It doesn’t matter if they are the best public servant you have ever had. Sweep the table clean and let a new mind-set in to office. And don’t vote for an incumbent until the system rights itself.

Second thing – get another political party going. Enough of these Republican/Mini-Republican electoral choices. A choice between the greater and the lesser evil isn’t much of a choice.

We the People of the United States, in Order to

- form a more perfect Union,

- establish Justice,

- insure domestic Tranquility,

- provide for the common defence,

- promote the general Welfare, and

- secure the Blessings of Liberty to ourselves and our Posterity,

do ordain and establish this Constitution for the United States of America.

This looks like some useful information.

That cornbread mix had been hiding in the cupboard too long.

There are a number of items I would like Congress to implement to start the economic justice pendulum heading back to sanity.

I believe this agenda falls under the mandate of the United States:

We the People of the United States, in Order to

- form a more perfect Union,

- establish Justice,

- insure domestic Tranquility,

- provide for the common defence,

- promote the general Welfare, and

- secure the Blessings of Liberty to ourselves and our Posterity,

do ordain and establish this Constitution for the United States of America.

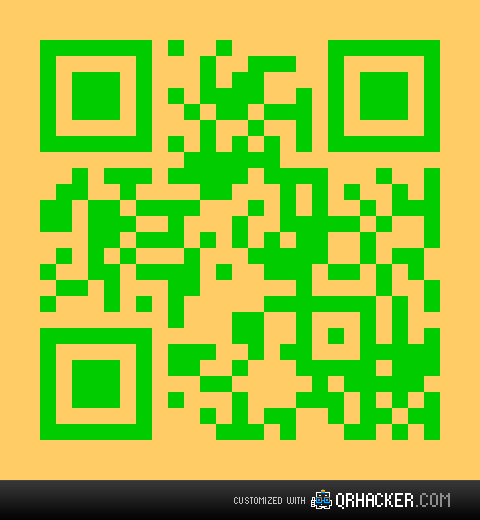

QR | What is a Quick Response barcode & how to create or read one.

Since I don’t have a smartphone, I haven’t really bothered with these 2D bar codes, but it looks like you can do a lot with them.

Beware the 12 Scams of Christmas | Smart Spending | Mainstreet.

Looks like there are more scam opportunities for QR codes.

There are some even more nefarious minds out there.

I just heard about ‘Shopping Walls‘. Basically, if you see something you want to buy, you take a smartphone picture of the code box next to a picture of item and you will be automatically routed to a web site where you can quickly seal the deal and get the item mailed to your home.

Now if I was of a nefarious bent of mind I would cover the little code box with a code box of my own and direct this person, who is about to disseminate credit card/account information and who expects to provide this information, to a dummy website of my own design that will collect the sensitive information. I might even relay the information through to the store so that the buyer does not notice that anything untoward may have happened.

(I don’t have a smart phone so I have no idea what they are doing.)